September 2023

Background

The government is poised to shutdown if a funding bill isn’t passed by September 30th. Speaker McCarthy is attempting to corral Republican support for a bill but is facing demands from the rightmost flank of the Republican caucus, including disagreements over funding for Ukraine. As of this writing, the House is expected to vote Tuesday evening on a package of bills, but it is not yet clear that he has the support needed.

Meanwhile, the Senate is moving forward with its own bipartisan short-term funding bill, though expectations are that the House would be unlikely to bring the bill to the floor or Speaker McCarthy could risk losing his speakership. If the House’s Tuesday evening vote fails, expect more bluster coming out of DC as the week moves on.

Looking Ahead

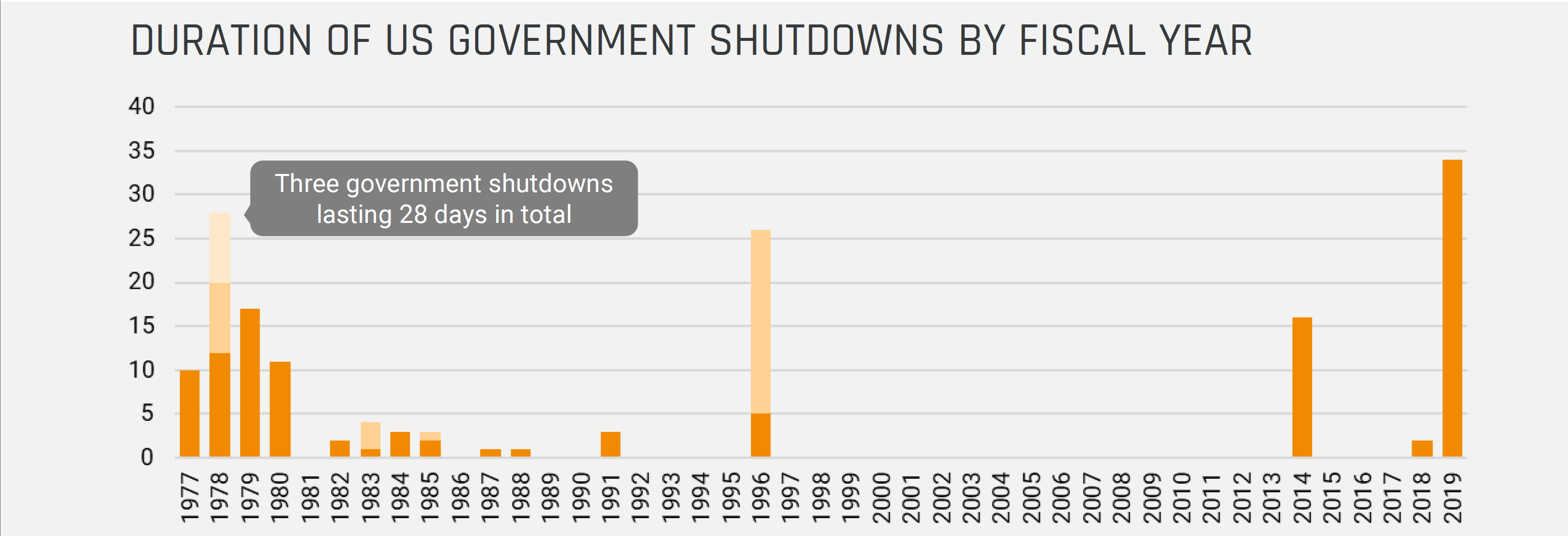

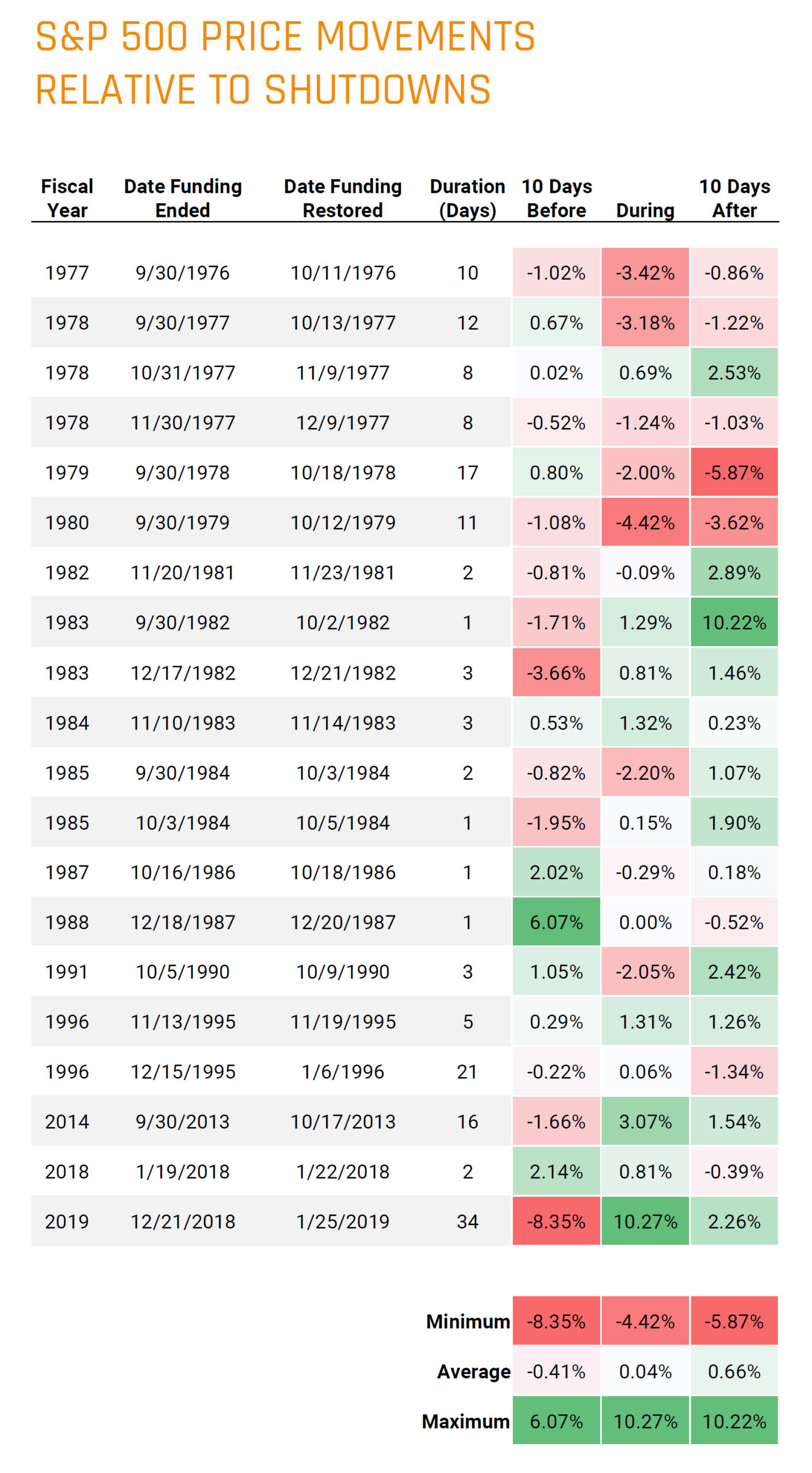

Typically, government shutdowns are fairly short. The longest shutdown in the last few decades came in 2019 and lasted 34 days, but most shutdowns tend to be shorter than 15 days. Like most political events, thankfully markets don’t tend to meaningfully react. The following page shows a table of market movements before, during, and after government shutdowns over the last few decades. However, it’s worth remembering that political dysfunction was one of the primary reasons Fitch gave when it downgraded the US government’s credit rating. This week, Moody’s – the only remaining agency giving the US a top rating – implied that its rating may be at risk ahead of the potential shutdown. Moody’s analysts noted while “debt service payments would not be impacted and a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength…”1

Looking Ahead (continued…)

As we’ve noted, market reactions are inconsistent across prior shutdowns. The table on the right summarizes the S&P 500’s price movements before, during, and after shutdowns going back to the late 1970s. There is little consistency across those time periods and the length of the shutdown does not appear to have any significant correlation to the market movements either.

While political dysfunction seems to be playing an increasing role in credit rating agencies’ assessment of the fiscal strength (or lack thereof) of the US government, the bond market will react well ahead of rating agencies.

Bottom Line:

Whether or not the government shuts down this weekend will have little lasting impact on investors beyond having to suffer another round of headache-inducing headlines and political quotes, something we’re sure to see again sometime soon.

Source: Helios Quantitative Research

Source 1: Bloomberg