May 2023

Background

The US government is facing a critical decision regarding the debt ceiling, a cap on government borrowing that affects only the ability to pay existing bills, not to approve more spending. Currently, the US is getting perilously close to the current limit of nearly $31.4 trillion, at which point it could lose the ability to meet its payment obligations. Treasury Secretary Yellen has warned of an “economic and financial catastrophe that will be of our own making” if the debt ceiling is not raised soon.

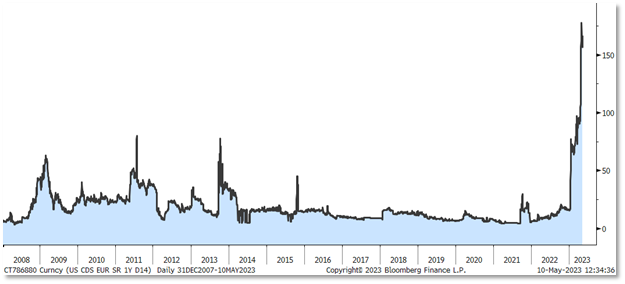

The debt ceiling has become an explosive political issue with the potential to roil financial markets, as failure to raise the ceiling could eventually result in a first-ever default on some of the government’s obligations. Over the past six decades, the US government has raised, extended, or revised the debt ceiling nearly 80 times under all party makeups in Congress and the White House. While it is still more likely than not that a deal is reached, over the last few weeks credit default swaps have surged, indicating the market is pricing in more risk of a US default. though those probabilities are in the low single digits. As of Tuesday, the CDS implied risk of default is around 3%.1

US 1-Year Credit Default Swaps

Implications

The implications of a default on the US government’s obligations could be severe. These include a partial government shutdown and missed payments to Social Security recipients, the military, Medicare providers, holders of Treasury securities, along with other government programs.

Failure to pay bondholders would have cascading effects, with credit rating agencies downgrading Treasury debt, leading to higher borrowing costs for the government, businesses, and households. In 2011 debt ceiling brinksmanship led to a downgrade in the United States’ credit rating, which temporarily roiled markets, though this only lasted a few months, which we explore further below. Additionally, most market pricing is based on a risk-free rate that is typically benchmarked to US Treasury bonds. If the risk-free rate is no longer risk-free, then pricing across all capital markets could be reset.

Damage to the economy would depend on how long the breach lasted. According to the Council of Economic Advisers, “a protracted default would likely lead to severe damage to the economy, with job growth swinging from its current pace of robust gains to losses numbering in the millions.”

What to Look for Next

More bluster coming from DC is likely the only guarantee right now. Republicans want to pair a debt limit hike with spending cuts while Democrats and the White House want a “clean” increase without strings attached. On April 26, House Republicans passed a bill that would raise the debt ceiling by $1.5 trillion while cutting spending by $4.8 trillion over 10 years. Negotiations are underway as the runway that the Treasury Department must continue to deploy extraordinary measures runs out.

While the current debt ceiling issue may seem more fraught than prior ones, it is a movie we have seen before, and likely will again. Historically, debt ceiling standoffs have only had temporary market impacts, despite generating plenty of noise from politicians. However, the US voluntarily defaulting would have significant and longer-lasting impacts and both the market and the economy. Thankfully, the odds of default remain low, despite having increased over the last few weeks. Expect headlines to continue with various tones ranging from “encouraged” to “frustrated” as negotiations continue between Congress and the White House.

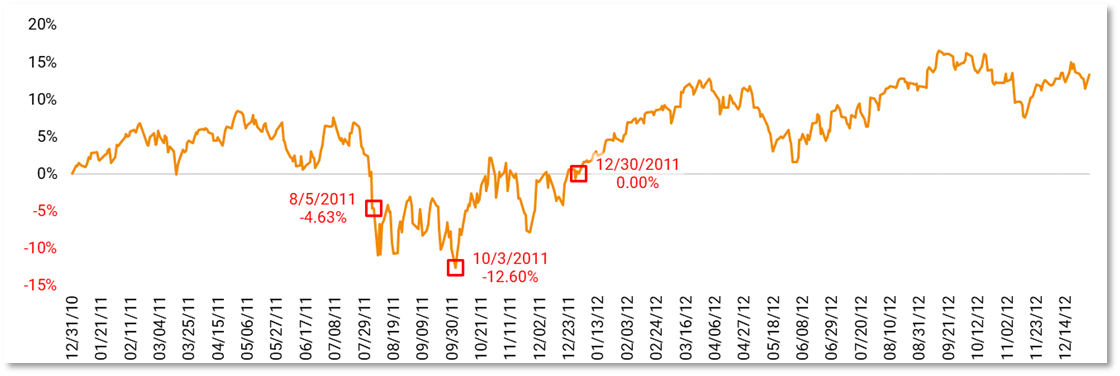

Historical Context: Debt Standoff led to US credit rating downgrade on August 5, 2011

S&P 500 cumulative price changes, December 31, 2010 to December 31 2012

Immediate Impact

The S&P 500 began trending down before the downgrade and was flat on a year-to-date basis two days before the downgrade. Over the next few days, the S&P 500 fell nearly 11%, and finally fell by over 12% over the next two months.

Medium-Term Impact

Equity volatility continued throughout the summer and the S&P 500 didn’t regain losses consistently until the end of 2011.

While the bout of volatility was unwelcome, the impacts were relatively short-lived.

Source: Helios Quantitative Research, Bloomberg