August 2022

Overview:

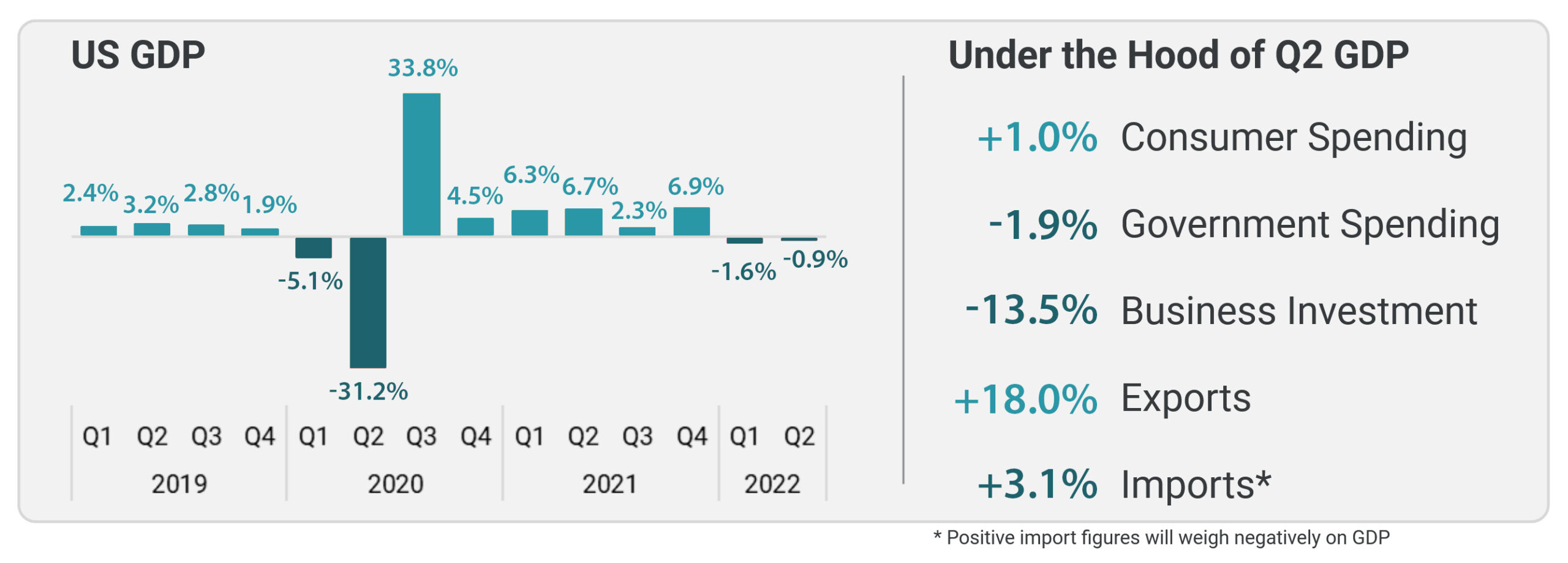

In the second quarter, the US economy shrank at a 0.9% annualized rate, making it the second decline in a row and propelling the debate of if the economy is in a recession. The report showed that the consumer has slowed a bit but continues to be resilient in the face of rising prices. Surging exports have also helped though businesses have significantly curtailed investment amid the uncertain environment. Weakness in real estate spending, as well as a drop in inventories and government spending, also weighed on GDP.

While the NBER makes the official recession call, this can be a sideshow for investors. The determination is always backward-looking and delayed. The current data set is undoubtedly mixed and weakening, though, at the end of the day, the attractiveness of markets will not be driven by the NBER but rather by corporate earnings, the state of the consumer, labor market, and the trajectory of inflation.

US GDP: By the numbers

Recession: To be or not to be?

A Few Technicalities

There is a lot of talk recently about what does or does not constitute a recession. The bottom line is two consecutive quarters of negative GDP does not meet the criteria for a recession and, in fact, GDP is not a primary factor when the NBER makes its call.

From the NBER on what defines a recession:

The committee’s view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.

And what indicators the NBER uses (emphasis ours):

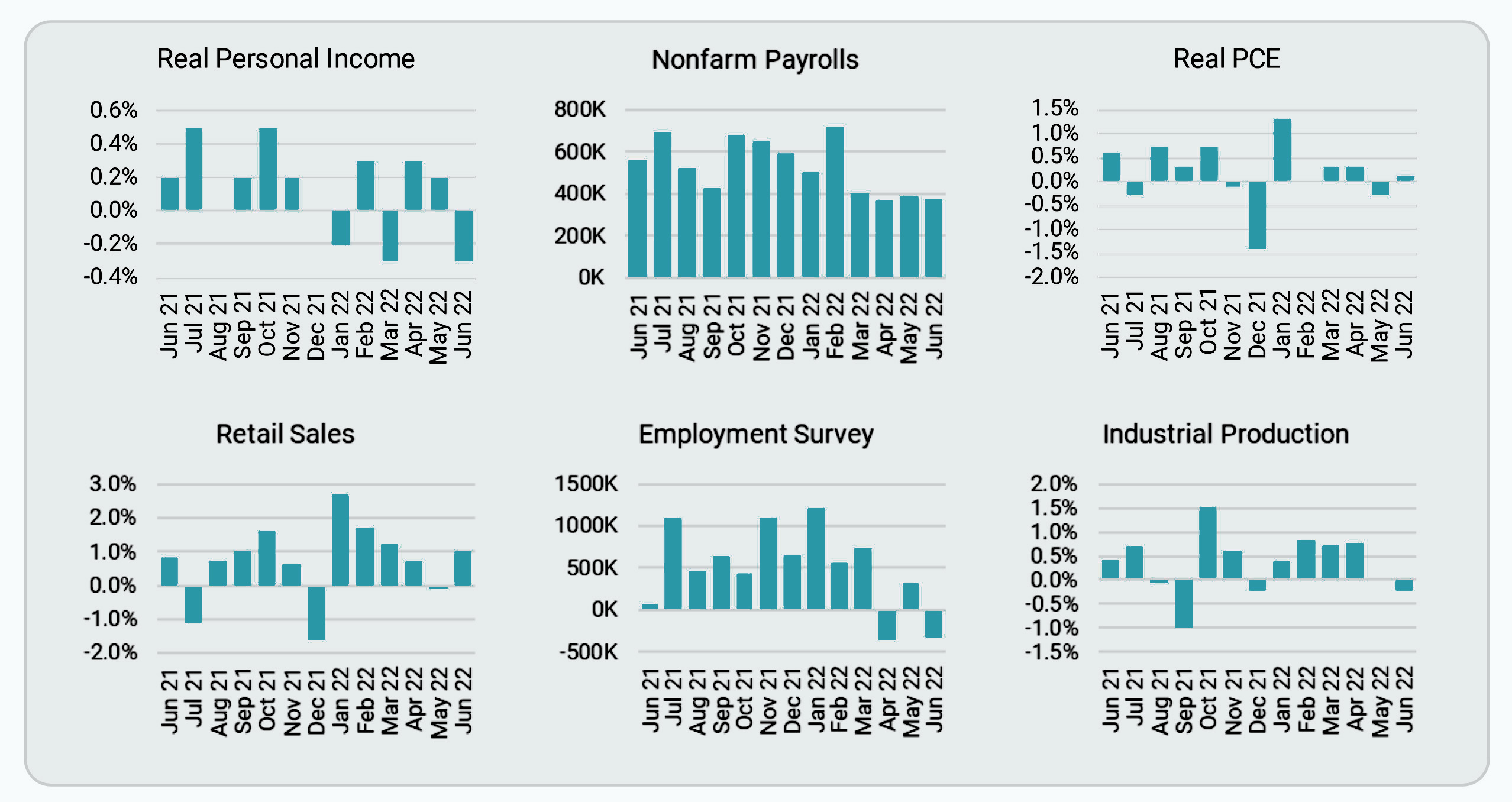

These include real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions.

A mixed bag of economic indicators

The Bottomline:

Proclaiming we are or are not in a recession is somewhat irrelevant because each recession is different. Using history as our guide, we know that some have been mild, while others have been brutal. The key is to analyze the data as it comes and make prudent decisions justified by actionable data sets and not emotional ones brought on by fear of the daily recession chatter.

Source: Helios Quantitative Research, Bloomberg