March 2022

Summary:

- As the Russia invasion of Ukraine escalates, we examined prior geopolitical events to provide historical context. While no two geopolitical events are the same, some caused temporary periods of market volatility while most did not have long-term impacts on the markets and economy overall.

- In response to Russian military mobilization, the US and European countries have imposed sanctions targeting Russian financial institutions and political power players, with more likely to come.

- Qualitatively, the biggest risk in this scenario is tied to global energy prices, Europe’s energy supply, and any industrial or manufacturing disruptions that could arise.

Market Returns

(YTD through 2-28-2022)

-8.01% S&P 500 Index (US stocks)

-6.52% MSCI EAFE (Int’l stocks)

-3.25% Bloomberg US

Aggregate Bond (US Bonds)

S&P 500 Reaction to Prior Geopolitical Events

There is little to no consistency in how markets react to geopolitical events, with each having their own distinct causes and implications.

| Event | Date | 1 Month | 3 Months | 6 Months | 12 Months |

|---|---|---|---|---|---|

| Germany Invades France | 5/10/1940 | -19.9% | -12.7% | -4.5% | -18.7% |

| Pearl Harbor Attack | 12/7/1941 | -1.0% | -11.0% | -6.5% | 4.3% |

| N. Korea Invades S. Korea | 6/25/1950 | -10.0% | 1.6% | 4.1% | 11.7% |

| Cuban Missile Crisis | 10/16/1962 | 5.1% | 14.1% | 20.7% | 27.8% |

| Yom Kippur War | 10/6/1973 | -3.9% | -10.7% | -15.3% | -43.2% |

| Oil Embargo | 10/16/1973 | -7.0% | -13.2% | -14.4% | -35.2% |

| Iraq’s Invasion of Kuwait | 8/2/1990 | -8.2% | -13.5% | -2.1% | 10.1% |

| 9/11 Terrorist Attacks | 9/11/2001 | -0.2% | 2.5% | 6.7% | -18.4% |

| Iraq War Began | 3/20/2003 | 1.9% | 13.6% | 18.7% | 26.7% |

| Russia Annexed Crimea | 2/20/2014 | 1.5% | 2.6% | 8.0% | 14.7% |

| Bombing of Syria | 4/7/2017 | 1.8% | 3.1% | 7.6% | 12.8% |

| Saudi Aramco Drone Strike | 9/14/2019 | -1.4% | 5.4% | -8.8% | 12.5% |

| Iranian General Killed in Airstrike | 1/3/2020 | 1.9% | -23.1% | -4.2% | 14.4% |

| US Pulls Our of Afganistan | 8/30/2021 | -3.7% | 2.8% | n/a | n/a |

| Range (High/Low of the period) | 25.0% | 37.2% | 36.0% | 71.0% |

Market Impact

Initial sanctions have been imposed on Russian banks and political allies, isolating them from western financing, with more sanctions being likely. In response to the invasion, Germany announced a halt to the Nord Stream 2 pipeline, while the UK plans to implement additional sanctions on Russian banks. A disruption of Russian energy exports could drive prices up since Russia produces approximately 10% of the world’s energy and 50% of the energy consumed in Europe.1 This may create some short-term volatility, which in turn may cause investors to look for safe havens such as bonds or gold, though these impacts are likely temporary.

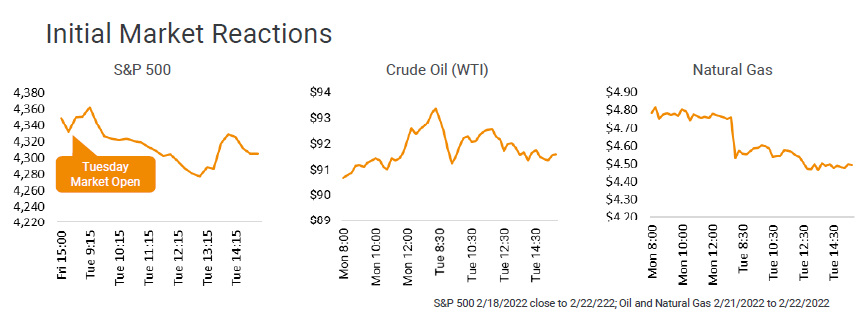

Europe could experience harsher impacts, as there is no easy alternative to replace Russian natural gas. The US is more insulated from much of the direct negative repercussions, such as potential energy shortages. However, it is still exposed to global energy prices and any additional inflationary pressures they can cause. As we can see in the charts above, the initial market reaction was relatively muted across US equities to oil and natural gas.

While hostilities are high, there are more important factors at play in markets than geopolitical tensions. Recent market volatility is being driven by expected Fed policy moves and inflation concerns, which are higher priorities for the market right now.

History Rhymes, Crimea Annexation: A Closer Look

- In February and March of 2014, Russia invaded and subsequently annexed the Crimean Peninsula from Ukraine.

- Taking a strictly market performance-based view, there wasn’t a lasting impact in equities or energy commodities.

- In short, it appears unlikely for there to be long-term consequences to US markets.

| Crimea Annexation | 12 Months |

|---|---|

| S&P 500 | 14.70% |

| Crude Oil (WTI) | -51.09% |

| Natural Gas | -9.69% |

| Percent price changes following 2/20/2014 |

The Bottomline:

- Market volatility, while unsettling, is normal, expected, and this time is no different given the number of headwinds we are facing.

- We will continue to monitor the data and adjust accordingly if (or when) the calculations suggest a high probability of a sustained market decline is on the horizon.

1Source: Fidelity

Source: Helios Quantitative Research, Bloomberg